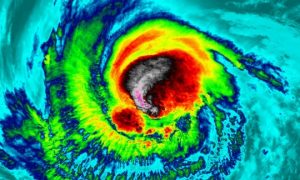

Hurricane season is in full force. At this time it has not had a direct impact on Selma, Alabama, but mother nature has dealt massive blows to other states already this year. As I write this Hurricane Irma is bearing down on Miami and the Caribbean Islands. Jose is supposed to turn right and stay in the Atlantic. We have some great hurricane forecasters out there that are able to predict the most likely storm paths, but they are unable to control the storm itself. At some point in time we will face a storm again in Alabama, but as of today we appear to be relatively safe compared to our some of friends in other states that we are praying for.

Irma is not forecasted at this time to have a huge impact on Alabama, but now is a great time to figure out what you and I need to in order to prepare for storms and disasters that could possibly damage our homes in Selma and other areas of Alabama.

First, let’s have a basic review of your Homeowners Insurance Policy. All policies are similar, but they are also different.

Homeowners Insurance policies are the same that they do NOT cover flood damage. During Hurricane Ivan and other disasters, it always seems like you hear about insurance companies trying to figure out if the storm surge (Flood) destroyed the home or did the wind destroy the home. If the flood causes the damage the homeowner would need flood insurance to have insurance coverage on their home. If the wind causes the damage, it will be covered on your homeowner’s insurance.

On you car insurance, flood insurance would be covered if you have comprehensive insurance coverage on your car and your policy is not cancelled.

For your home, here are some basic tips in preparation (well before) of storm for your Home Insurance and Car insurance.

- Meet with your insurance agent at The Frazer Group and review your insurance coverages.

- Many items like jewelry, guns, furs, and silver only have limited coverage on a Homeowners policy with a high deductible. Call The Frazer Group and we will help you add a “personal articles floater” on your Home Insurance. This will lower your deductible a lot on these items and it is very affordable insurance.

- Pay your premiums on time to avoid lapses in coverage. Did you know that once a hurricane enters the Gulf of Mexico heading near our state most insurance companies will suspend what is known as “Binding Authority”. This means if your policy is cancelled for nonpayment it cannot be reinstated until after the storm passes through. You do not want this to happen, because you could get caught without coverage.

- Complete a home inventory:

- You could write down a list of everything in your home and their value before anything ever happens to your home.

- You could take pictures of your home.

- You could shoot a video walking through your home.

- Any of these would be very helpful in the event of a covered insurance claim to your home.

- In the event of an impending storm, like IRMA, protect your property, because that is easier than an insurance claim and it is easier to return to a normal lifestyle once the storm passes.

- Board windows where branches or flying objects could break out windows. This could help prevent a lot of other damage from happening.

- Secure loose belongings around your property so they don’t become flying objects. (For example, we moved our patio furniture further into the backyard away from the glass by our sun room during Ivan)

- Make sure you find a safe place if there is not one at your home or in your community.

- Make sure you are prepared to be without power for a long time. Even in Selma, Alabama my neighbor was without power for seven days after Ivan came through. Plenty of cold water, but no hot water.

- Have the claims number available for your insurance company or have your insurance agents cell phone number. At the Frazer Group, my cell phone number is on my business card. You can call it. Also, our website, www.frazergroup.com/contact, will still be up and running and you will be able contact us.

- If damage does occur here are some tips to help in filling the claim and helping the claim to be settled in a timely manner.

- Take pictures

- Prevent further damage to your home and belongings. These expenses are usually covered. Your policy has wording addressing this and it is usually pretty clear that you are to take measures to prevent further damage. PLEASE read this to make sure. It will only take a few minutes.

- File your claim with your insurance company or your agent at the Frazer Group. Our website, www.frazergroup.com/contact, has a place where you can reach out to us at any time. You will also find all of our emails on our website as well. https://www.frazergroup.com/about/

- After the dust settles, you can help the claim to be settled sooner by gathering the information the adjuster requests in a very timely manner. The adjuster will probably need the following information and you can begin working on soon after the insurance claim to your home, even before you speak with the insurance adjuster.

- Make a list of the damaged property. If it is personal property try to determine what you originally paid for the item. If you have the receipt that would be great. If not, list it and move on. If you know what that item will cost now, you can write that down as well.

- Get at least two estimates for any clean up of trees that might have fallen on your damaged property.

- Get at least two estimates for the repair of your property

- Do NOT repair until you get the go ahead from your insurance adjuster.

- Communicate regularly with you agents at The Frazer Group on the progress of your claim. You will not be a bother to us, this is what we are here for. Ask us questions and we will work to get you answers if we do not have the. Remember at the Frazer Group we are an independent insurance agency in Selma and we work for you.

We hope this helps you as we all prepare for Irma and pray that it just simply goes away. In the event that it does continue on, we join others in praying for the people in its path. God never promised there would not be storms in our lives, but He did promise to walk through them with us. God bless and may you and yours be protected during these times.